As a QB ProAdvisor, I visit with many people using QuickBooks and see many common errors over and over again, particularly among businesses who did not get training. Here are my top five:

1. Not using the Open Windows panel for easy navigation.

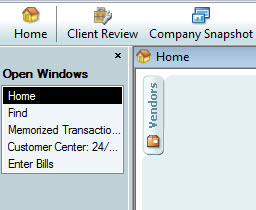

QuickBooks Open Windows List

This one is simple, yet I see relatively few people using it. In order to easily switch between multiple windows already open in QuickBooks, use the Open Windows list. Activate this on the View menu: View > Open Windows List.

2. Failure to regularly reconcile bank accounts AND credit card accounts.

If you don’t keep up with reconciling your accounts, including credit card accounts, QB can’t help you keep in touch with your financial status. It’s easy to miss deductions made by the bank – and trying to play catch-up on several months worth of statements is no fun!

3. Improper handling of credit card expenses.

Expensing a credit card payment as a “credit card expense” is not the proper way to track expenses charged to a credit card. There are two methods here – the right one for you depends on whether you pay off the entire balance each month or if you ever carry a balance forward. If you ever carry a balance forward, set your credit card up in the Chart of Accounts, and reconcile the account each month. Make the credit card payment at the end of the reconciliation, “expensed” to the credit card in your chart of accounts.

4. Confusion over bill paying versus check writing.

A symptom that this confusion has occurred is an Accounts Payable that’s not accurate, with your QB showing you still owe a bill you know you’ve paid. If you enter a vendor’s invoice as a bill, you must pay it as a bill, which is not done by the “Write Check” method (even though you’ll be issuing a check). If you have done this, and you see that you have written a check to pay for the outstanding bill, simply delete the bill. Open the bill, click Edit > delete bill (or you may void the bill, also on the edit menu).

Is it necessary to enter a bill for everything? No. If you are going to be paying an invoice immediately on receipt,

simply “Write a Check” (in QB). It is not necessary to enter it as a bill first, unless your accountant or company policy requires everything go through QB Accounts Payable.

5. Improper handling of customer invoice payments.

The symptom of this problem is an Accounts Receivable that shows customers still owing you money when you know you have deposited their payment. If there is an invoice for a customer, you must “Receive Payment” on the invoice in QB. After receiving payment, make the QB deposit from Undeposited Funds for all checks being deposited that day.

Remember – the single best thing you can do to improve your

confidence and productivity at your computer is to get training.

We can help.